The Supreme Court today upheld the constitutional validity of the Aadhaar scheme but imposed some restrictions on its use The top court said Aadhaar is serving much bigger public interest and Aadhaar means unique and it is better to be unique than being best.

Here are some highlights from Supreme Court ‘s verdict on Aadhaar:

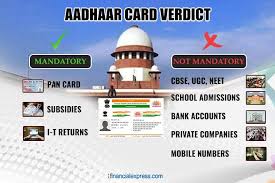

Supreme Court strikes down the Section 57 of Aadhaar Act; as a result, private companies cannot ask for Aadhaar card

Aadhaar mandatory for filing of income tax returns (ITR) and allotment of Permanent Account Number (PAN)

Aadhaar not mandatory for opening of bank account

No mobile company can demand “Aadhaar card”

Aadhaar need not be made compulsory for school admissions

CBSE, NEET, UGC cannot make Aadhaar mandatory

Telecom service providers can’t seek linking of Aadhaar

Not mandatory to link Aadhaar to bank accounts

Author Profile

- India Writes Network (www.indiawrites.org) is an emerging think tank and a media-publishing company focused on international affairs & the India Story. Centre for Global India Insights is the research arm of India Writes Network. To subscribe to India and the World, write to editor@indiawrites.org. A venture of TGII Media Private Limited, a leading media, publishing and consultancy company, IWN has carved a niche for balanced and exhaustive reporting and analysis of international affairs. Eminent personalities, politicians, diplomats, authors, strategy gurus and news-makers have contributed to India Writes Network, as also “India and the World,” a magazine focused on global affairs.

Latest entries

In ConversationJuly 26, 2024India-Italy defence collaboration can extend to third countries: Anil Wadhwa

In ConversationJuly 26, 2024India-Italy defence collaboration can extend to third countries: Anil Wadhwa In ConversationJuly 23, 2024Italy views India as a key partner in Indo-Pacific: Vani Rao

In ConversationJuly 23, 2024Italy views India as a key partner in Indo-Pacific: Vani Rao DiplomacyJune 29, 2024First BRICS unveils a roadmap for boosting tourism among emerging economies

DiplomacyJune 29, 2024First BRICS unveils a roadmap for boosting tourism among emerging economies India and the WorldJune 11, 2024On Day 1, Jaishankar focuses on resolving standoff with China

India and the WorldJune 11, 2024On Day 1, Jaishankar focuses on resolving standoff with China