By Xin Ping

As my social media feeds and web browsers are flooded with the word “overcapacity” lately, I can’t stop wondering why this old economic term is suddenly turning into a buzzword, especially in the context of China-U.S. trade tensions.

Overcapacity, as the term suggests at first look, occurs when the production capacity of a certain sector significantly exceeds demand, leading to a surplus of goods and, in most cases, lower prices. But still, this definition cannot address my question of why the U.S. is talking about this to China, until I came across an op-ed by Professor Jeffrey Sachs, who plainly explained that the latest “China overcapacity campaign” launched by the U.S. is based on a mix of arrogance, nastiness, and naiveté.

Arrogance: Mirror, mirror on the wall, who’s the winner of them all?

Among the global 500 new energy enterprises of 2023, over half were from China, showing a clear advantage of China on the global clean technology market. China now produces 80% of the world’s solar panels, 40 times that of the U.S., and makes about two-thirds of the world’s NEVs, wind turbines, and lithium batteries. Chinese firms are challenging U.S. and European dominance over the clean sector.

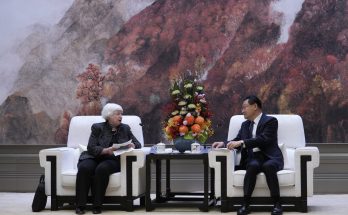

When they cannot win the race, they try to slow it down. Getting anxious over China’s rise in NEVs and other clean energy technologies, some Western politicians have made up an “overcapacity” narrative. U.S. Treasury Secretary Janet Yellen claims that China “distorts global prices” and “hurts American firms and workers.”

Nastiness: It’s better not to burn your bridges behind you.

If you take a close look at history, the West had been amassing riches by disposing of surplus products to the less developed for centuries, often on unfair terms—a nasty and brutal process that left lasting scars on countries like China. In the 1840s, imperial Britain forced China to open her doors to foreign trade and, indeed, opium. Only decades ago, the U.S. did not complain when China traded tens of millions of shirts for one Boeing airplane, because it was clear who enjoyed the market privilege then.

If Washington and Brussels practice what they preach about market rules and fair competition, why weren’t they upset about China’s manufacturing capacity in clothes, toys, and other low-value goods? Such double standards calls into question the validity of their accusations and reveals their real intention of slowing down China’s growth. They are only concerned because they are losing market dominance to China in what they consider as critical sectors.

Naiveté: The West junks economics to accuse China of overcapacity.

Trade diversifies consumers’ options. If countries produced just enough to meet their domestic demand, there would be no cross-border trade. These are just elementary-level economics. Adam Smith would turn in his grave if one insists on defining “overcapacity” narrowly as a productive capacity that exceeds domestic demand. Because the so-called “overcapacity” is just a sign of a functioning market where supply-demand imbalance is the norm.

The math is simple, and the truth is bitter. Consumers will pay the price for the “overcapacity” narrative against China. Everyone knows freer trade and lower tariffs help to keep costs low globally, yet Western politicians always find it hard to resist the urge to protect their domestic suppliers and crack down on foreign players. That’s how protectionism is bred. Ultimately, it will be higher car prices for drivers and larger electricity bills for households. The enduring headwinds against globalization will produce more victims all over the world.

As China grows and moves up the global value chain, the West is shocked by its emerging prowess and market competitiveness. There were no complaints about China’s “overcapacity” in the past because the capitalists had vested interests, and the reason why they have raised the issue today is nothing but arrogance, nastiness, and naiveté.

(The author is a commentator on international affairs, writing regularly for Xinhua News, Global Times, China Daily and CGTN)

(The views expressed in this article are solely those of the author)

Author Profile

- India Writes Network (www.indiawrites.org) is an emerging think tank and a media-publishing company focused on international affairs & the India Story. Centre for Global India Insights is the research arm of India Writes Network. To subscribe to India and the World, write to editor@indiawrites.org. A venture of TGII Media Private Limited, a leading media, publishing and consultancy company, IWN has carved a niche for balanced and exhaustive reporting and analysis of international affairs. Eminent personalities, politicians, diplomats, authors, strategy gurus and news-makers have contributed to India Writes Network, as also “India and the World,” a magazine focused on global affairs.

Latest entries

In ConversationJuly 26, 2024India-Italy defence collaboration can extend to third countries: Anil Wadhwa

In ConversationJuly 26, 2024India-Italy defence collaboration can extend to third countries: Anil Wadhwa In ConversationJuly 23, 2024Italy views India as a key partner in Indo-Pacific: Vani Rao

In ConversationJuly 23, 2024Italy views India as a key partner in Indo-Pacific: Vani Rao DiplomacyJune 29, 2024First BRICS unveils a roadmap for boosting tourism among emerging economies

DiplomacyJune 29, 2024First BRICS unveils a roadmap for boosting tourism among emerging economies India and the WorldJune 11, 2024On Day 1, Jaishankar focuses on resolving standoff with China

India and the WorldJune 11, 2024On Day 1, Jaishankar focuses on resolving standoff with China