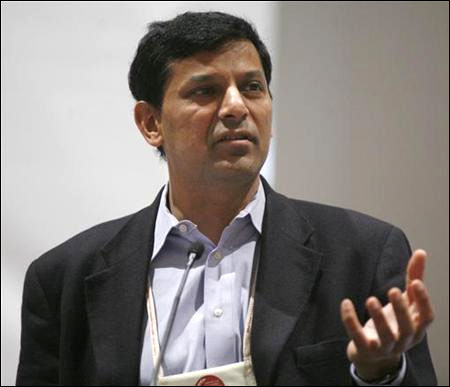

In the first bimonthly monetary policy review for the current financial year, 2015-2016, Reserve Bank of India (RBI) Governor Raghuram Rajan severely criticized banks for not passing on benefits of interest rates cut to borrowers (RBI had cut the repo rate by 50 basis points in two stages in January and March to the current 7.5%), and rubbished the claims that banks’ marginal cost of funding had not fallen despite the rate cuts.

In the first bimonthly monetary policy review for the current financial year, 2015-2016, Reserve Bank of India (RBI) Governor Raghuram Rajan severely criticized banks for not passing on benefits of interest rates cut to borrowers (RBI had cut the repo rate by 50 basis points in two stages in January and March to the current 7.5%), and rubbished the claims that banks’ marginal cost of funding had not fallen despite the rate cuts.

The sooner the banks cut their rates, the better it would be for Indian economy, since it makes borrowing (and therefore productive investment) cheaper. Mr Rajan said that the RBI wanted to facilitate the transmission of the recent rate cuts to the borrowers and that comfortable liquidity conditions, along with the reduction in marginal cost of funding (owing to rate cuts), ought to allow a banks to transmit lower repo rate into their lending rates, and boost financing for the productive sectors in the economy. He added that “there is an incentive for banks to lower rates in April as a high amount of liquidity would be released into the banking system”.

According to Mr Rajan, banks would be forced to slash lending rates due to the mounting pressure. Many borrowers are directly borrowing from the corporate. He concluded that ultimately the rates would come down. Though monetary policy does work with a lag, the RBI had been worried about lack of policy transmission into real economy, despite two successive cuts. Hours after the Governor’s tough talk, three leading banks- SBI, HDFC and ICICI cut their interest rates.

The RBI recently celebrated its 80 year anniversary, and Indian Prime Minister Narendra Modi, speaking at a conference on financial inclusion organized at the occasion, congratulated the institution for its indispensable role in the Indian economy. He also congratulated Mr Rajan, for his stellar performance as the Governor.

Other important takeaways from the bimonthly review were that the policy rates remained unchanged (as expected, Cash Reserve Ratio and repo rate remained at 4% and 7.5%, respectively), untimely rains and speculations on the monsoon front were flagged as important considerations for food inflation (January 2016 target of 6% should be met though), the growth rate for the year was be about 7.8% (up from 7.5% in FY’15) and India is better positioned to deal with global financial volatility.

Author Profile

- India Writes Network (www.indiawrites.org) is an emerging think tank and a media-publishing company focused on international affairs & the India Story. Centre for Global India Insights is the research arm of India Writes Network. To subscribe to India and the World, write to editor@indiawrites.org. A venture of TGII Media Private Limited, a leading media, publishing and consultancy company, IWN has carved a niche for balanced and exhaustive reporting and analysis of international affairs. Eminent personalities, politicians, diplomats, authors, strategy gurus and news-makers have contributed to India Writes Network, as also “India and the World,” a magazine focused on global affairs.

Latest entries

In ConversationJuly 26, 2024India-Italy defence collaboration can extend to third countries: Anil Wadhwa

In ConversationJuly 26, 2024India-Italy defence collaboration can extend to third countries: Anil Wadhwa In ConversationJuly 23, 2024Italy views India as a key partner in Indo-Pacific: Vani Rao

In ConversationJuly 23, 2024Italy views India as a key partner in Indo-Pacific: Vani Rao DiplomacyJune 29, 2024First BRICS unveils a roadmap for boosting tourism among emerging economies

DiplomacyJune 29, 2024First BRICS unveils a roadmap for boosting tourism among emerging economies India and the WorldJune 11, 2024On Day 1, Jaishankar focuses on resolving standoff with China

India and the WorldJune 11, 2024On Day 1, Jaishankar focuses on resolving standoff with China